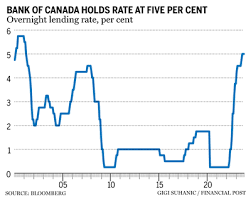

The Bank of Canada has decided to maintain its policy rate at five per cent for the fourth consecutive meeting. In a significant shift, the bank explicitly stated that there won't be a need for further increases if the economy aligns with its forecasts.

Governor Tiff Macklem and other policymakers opted for this expected pause, citing data indicating a stalled economic growth that is expected to remain slow in the near term. The objective is to bring inflation back to the bank's targeted two per cent next year.

Macklem conveyed a clear consensus to maintain the policy rate at the current level, indicating a shift in discussions from whether monetary policy is restrictive enough to how long the current stance should be maintained. The bank's dovish communication suggests a perception of a rapidly slowing economy and confidence that the past rate increases (475 basis points in less than two years) will be sufficient to control inflation, potentially paving the way for rate cuts in the coming months.

The Canadian dollar depreciated following the announcement, erasing earlier gains. Governor Macklem emphasized the need to balance the risks of over- and under-tightening, expressing concerns about persistent underlying price pressures. Although the possibility of further rate increases hasn't been ruled out, the bank removed language indicating its preparedness to hike again.

The bank emphasized the importance of observing "further and sustained easing" in core inflation and will focus on the balance between demand and supply, inflation expectations, wage growth, and corporate pricing activity.

Economic forecasts suggest a modest excess supply, leading to a slight adjustment in the growth projection for this year to 0.8 per cent. Despite this, the bank's base case anticipates a soft landing with growth picking up in the middle of the year.

Inflation is expected to hover close to three per cent in the first half of 2024 before declining to around 2.5 per cent by the end of the year, returning to the bank's two per cent target in the following year.

The bank acknowledges ongoing excess supply impacting prices, with corporate pricing behavior and inflation expectations gradually returning to normal. Wage growth, currently at a four to five per cent yearly pace, is expected to slow, aligning closer with inflation and modest productivity growth.

While shelter price inflation is expected to remain elevated, growth in mortgage interest costs is anticipated to slow gradually. Rental price inflation is forecast to moderate due to a slowdown in population growth and an expected increase in new housing construction.

One of the main risks highlighted by the bank is a stronger-than-expected rise in house prices, which could drive inflation higher than anticipated. Given Canada's higher debt loads and shorter-duration mortgages, the country's economy is deemed more rate-sensitive than its peers. The prevailing sentiment among economists and traders is an anticipation of a policy rate cut by June.

Post a comment